Starting with how much is auto insurance in Massachusetts, this paragraph aims to draw in readers with an intriguing overview of the topic. Auto insurance in Massachusetts is a crucial aspect of owning a vehicle in the state, with various factors influencing the rates. From understanding the basics of auto insurance to exploring ways to save on premiums, this discussion covers everything you need to know.

Moving forward, we will delve into the key factors that impact auto insurance rates in Massachusetts, compare average costs with neighboring states, and provide insights on selecting the right coverage.

Overview of Auto Insurance in Massachusetts

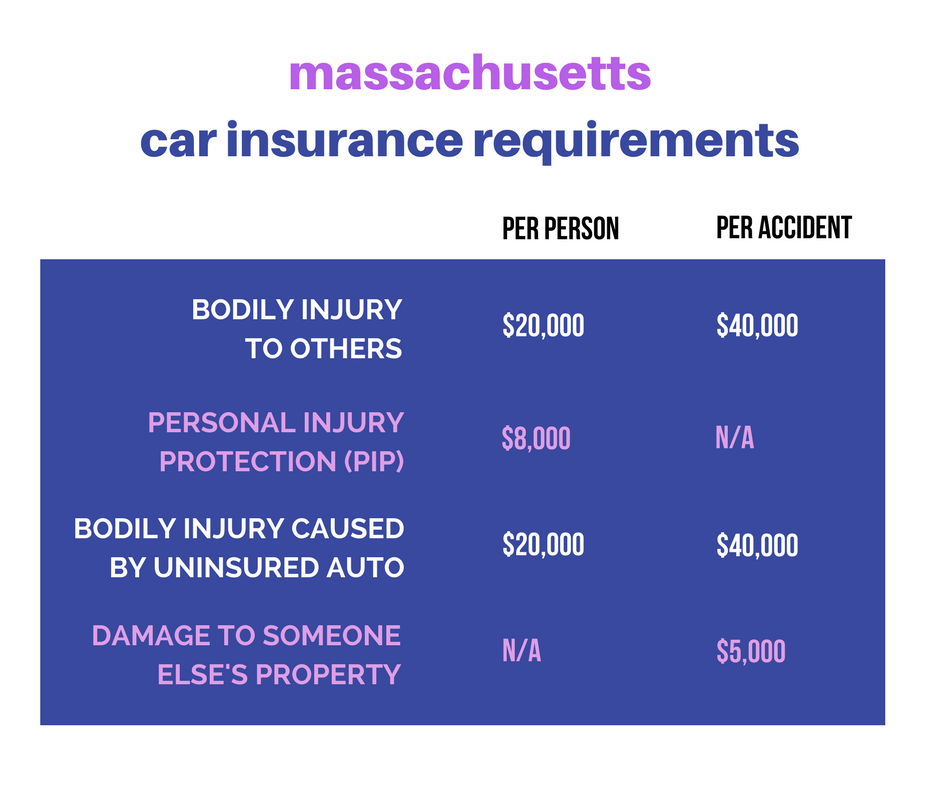

Auto insurance in Massachusetts is mandatory for all drivers to ensure financial protection in case of accidents. The state follows a no-fault system, meaning each driver’s insurance covers their own medical expenses regardless of who is at fault. There are several types of coverage available, including liability, personal injury protection (PIP), collision, and comprehensive. Having auto insurance in Massachusetts is crucial to comply with state laws and protect yourself from financial liabilities.

Factors Affecting Auto Insurance Rates

Several key factors influence auto insurance rates in Massachusetts. Age, driving record, and the type of vehicle are significant determinants of insurance premiums. Younger drivers and those with a history of accidents or traffic violations typically face higher rates. The location where you live and the coverage limits you choose also impact insurance costs significantly.

Average Cost of Auto Insurance in Massachusetts

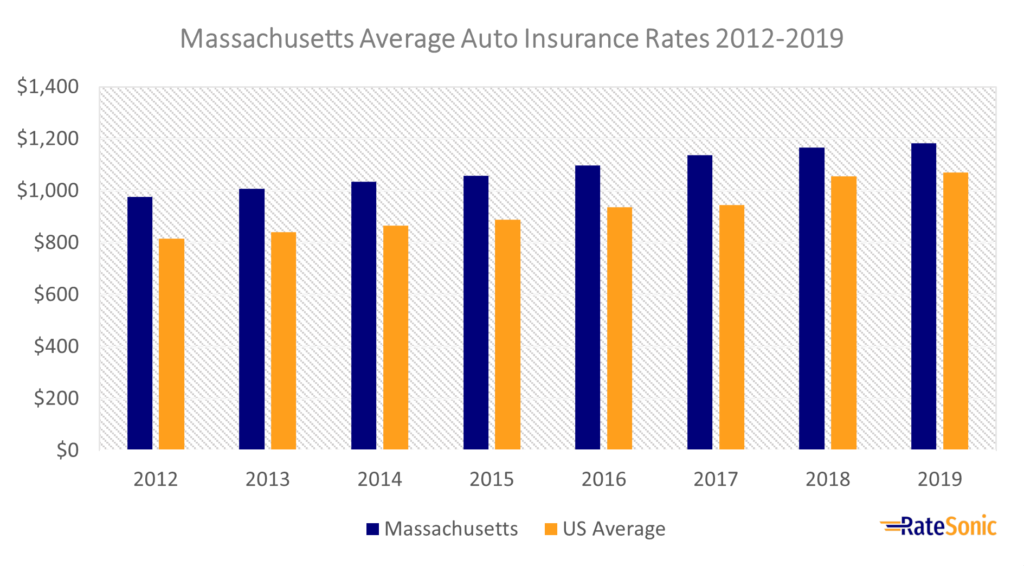

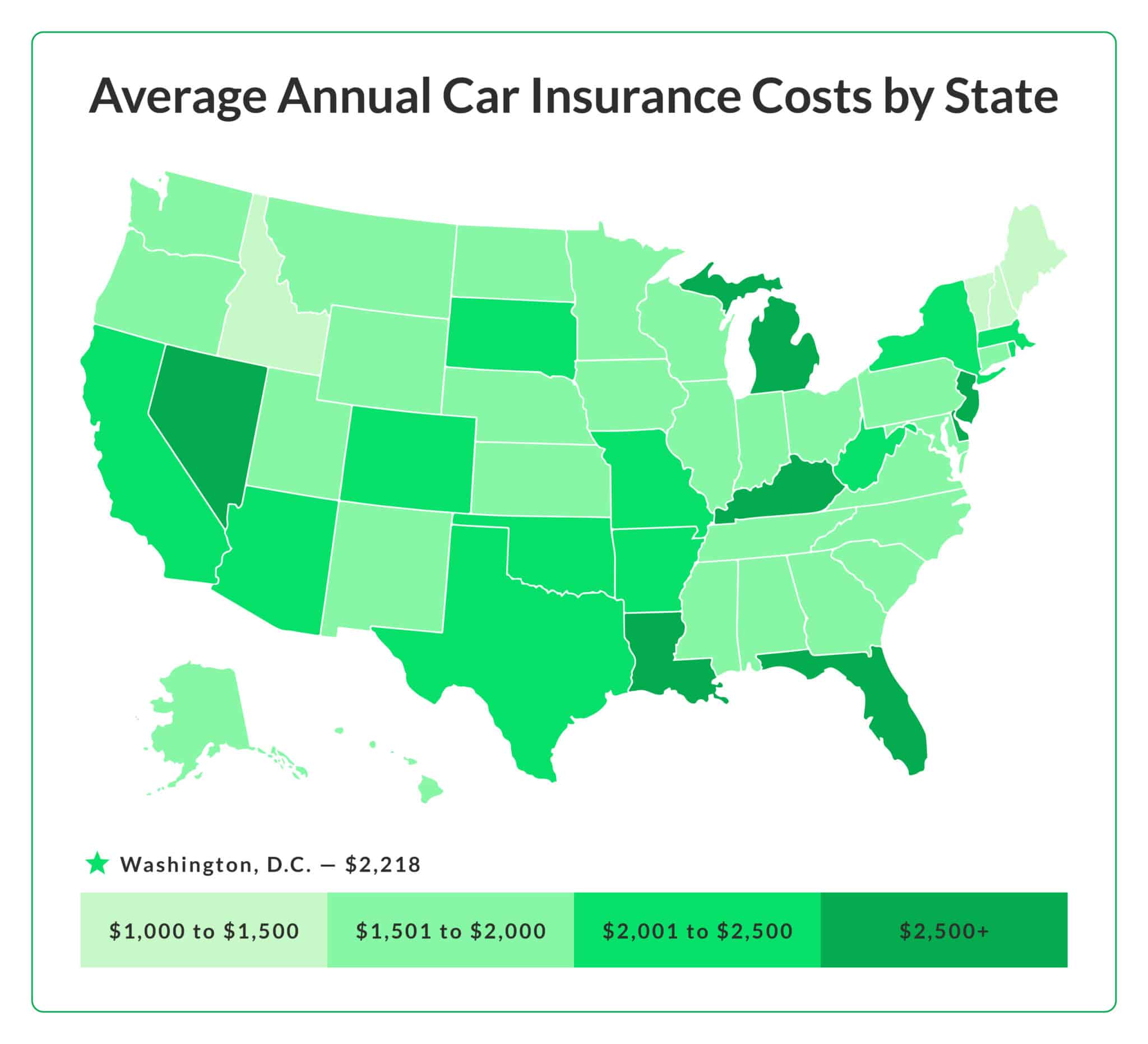

The average cost of auto insurance in Massachusetts is around $1,200 to $1,300 per year, which is slightly above the national average. Rates may vary depending on the driver’s profile, coverage options, and insurance company. Comparing rates with neighboring states like New York or Connecticut can provide insights into why Massachusetts rates may be higher or lower.

Ways to Save on Auto Insurance, How much is auto insurance in massachusetts

To save on auto insurance in Massachusetts, drivers can take advantage of discounts offered by insurance companies. These discounts may include safe driver rewards, bundling policies, or installing safety features in your vehicle. Selecting the right coverage tailored to your needs and driving habits can also help reduce costs significantly.

Final Conclusion

In conclusion, auto insurance in Massachusetts is a significant consideration for drivers in the state. By understanding the factors affecting insurance rates and exploring ways to save on premiums, individuals can make informed decisions when it comes to protecting their vehicles. Stay informed, compare quotes, and make the most of available discounts to ensure you have the coverage you need at a competitive price.

Question & Answer Hub: How Much Is Auto Insurance In Massachusetts

What are the average auto insurance rates in Massachusetts?

The average cost of auto insurance in Massachusetts is around $1,200 to $1,300 per year.

How can I save on auto insurance in Massachusetts?

Drivers in Massachusetts can save on auto insurance by bundling policies, maintaining a good driving record, and taking advantage of available discounts.

Do insurance companies in Massachusetts offer discounts?

Yes, insurance companies in Massachusetts often provide discounts for factors like good grades for students, safe driving courses, and multi-vehicle policies.