Commute or pleasure car insurance Reddit sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Exploring the differences between these types of car insurance and how they impact your coverage and costs is essential for making informed decisions.

Types of Car Insurance

Commute and pleasure car insurance are two common types of car insurance that cater to different driving habits and needs. Commute car insurance is designed for individuals who use their vehicles for regular commuting to work or school, while pleasure car insurance is suitable for those who primarily use their vehicles for leisure activities.

Commute Car Insurance

Commute car insurance is ideal for individuals who have a daily commute to work or school. This type of insurance typically covers accidents that occur during commuting hours, providing financial protection in case of any mishaps on the road.

Pleasure Car Insurance

Pleasure car insurance is tailored for individuals who use their vehicles for non-work-related purposes, such as weekend outings, vacations, or recreational activities. This type of insurance offers coverage for accidents that happen during leisurely drives, ensuring peace of mind while enjoying your time on the road.

Factors Influencing Insurance Premiums: Commute Or Pleasure Car Insurance Reddit

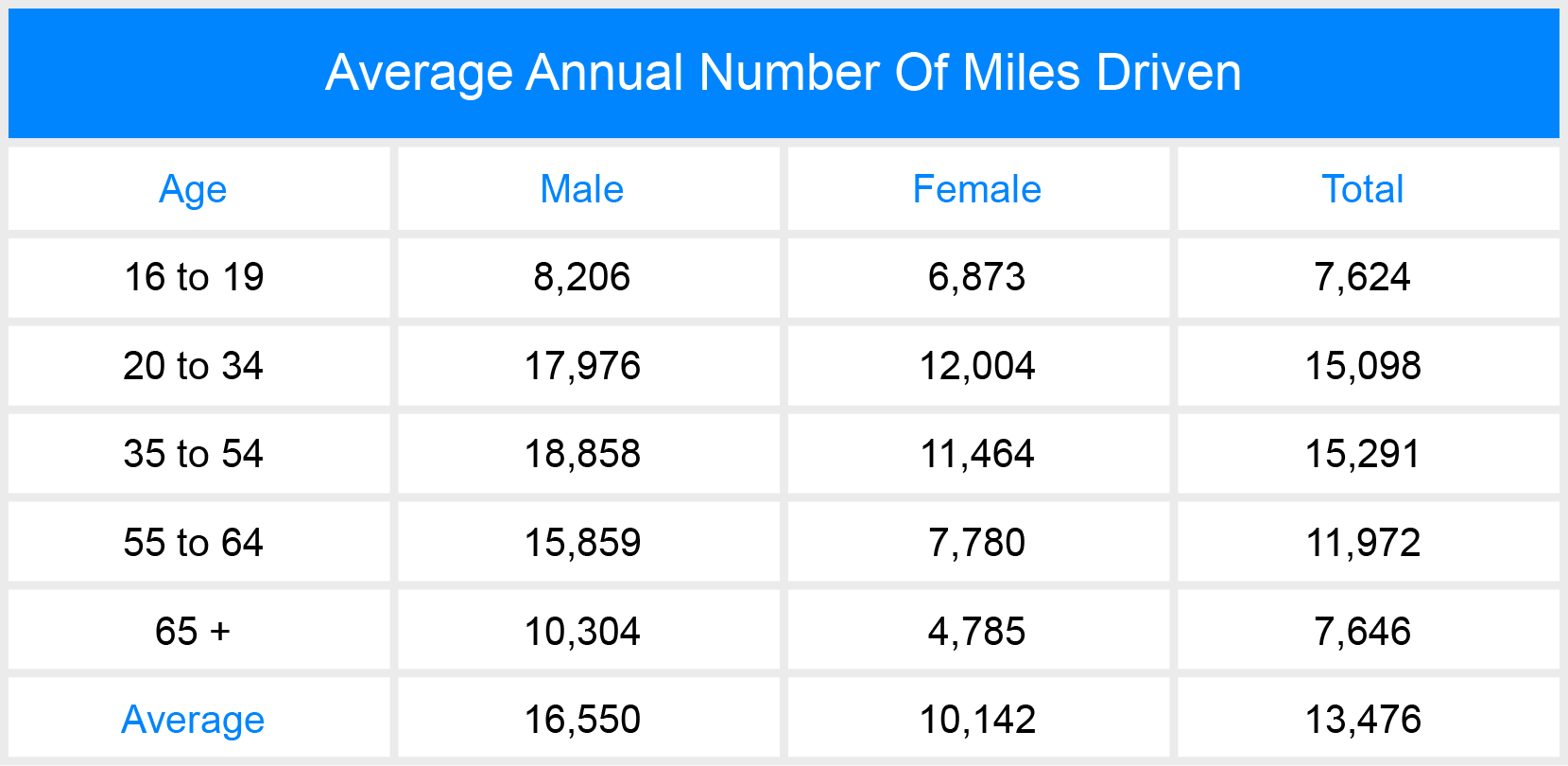

Various factors can influence the cost of commute car insurance, including the driver’s age, driving record, type of vehicle, and location. The frequency of car usage also plays a significant role in determining insurance premiums, as individuals who commute long distances are more likely to encounter accidents compared to those who drive shorter distances.

Frequency of Car Usage, Commute or pleasure car insurance reddit

The frequency of car usage directly impacts insurance premiums, as individuals who use their vehicles more often are considered to be at a higher risk of accidents. Commute car insurance premiums are typically higher for individuals with longer daily commutes, as they are more exposed to potential road hazards.

Type of Commute

The type of commute, whether it’s a long-distance commute or a short-distance one, can also affect insurance rates. Individuals with shorter commutes may enjoy lower insurance premiums compared to those with longer commutes, as the latter group is more likely to spend more time on the road and encounter higher risks.

Benefits of Pleasure Car Insurance

Pleasure car insurance offers several advantages, including lower premiums compared to commute car insurance, flexible coverage options, and peace of mind while driving for leisure. This type of insurance is beneficial for individuals who use their vehicles sporadically and want to save on insurance costs without compromising coverage.

Cost and Coverage Comparison

When comparing pleasure car insurance with other types of insurance, it’s essential to consider the cost and coverage benefits. Pleasure car insurance typically offers lower premiums due to the reduced risk associated with leisure driving, making it a cost-effective option for drivers who primarily use their vehicles for non-work-related activities.

Choosing the Right Insurance Policy

Selecting the most appropriate insurance policy depends on individual needs and driving habits. It’s crucial to understand the terms and conditions of the policy, compare coverage options, and assess the cost-effectiveness of each insurance type before making a decision.

Tips for Selecting an Insurance Policy

– Evaluate your driving habits and determine whether you need commute or pleasure car insurance.

– Compare quotes from different insurance providers to find the best coverage at competitive rates.

– Review the policy terms and conditions carefully to ensure you understand the coverage and exclusions.

– Consider additional coverage options, such as roadside assistance or rental car reimbursement, to enhance your insurance policy.

Epilogue

In conclusion, understanding the nuances between commute and pleasure car insurance is crucial for selecting the right coverage that aligns with your needs and budget. Whether you’re a daily commuter or a weekend driver, knowing the benefits and factors influencing premiums can help you navigate the complex world of car insurance more effectively.

Query Resolution

What is the difference between commute and pleasure car insurance?

Commute car insurance is for daily travel to and from work, while pleasure car insurance is for personal use, like weekend outings.

How does the type of commute affect insurance rates?

The distance and frequency of your commute can impact insurance rates, with longer commutes generally costing more.

What are the advantages of having pleasure car insurance?

Pleasure car insurance offers lower rates and coverage tailored for leisure driving, making it cost-effective for occasional drivers.

How can I choose the right insurance policy for my needs?

Consider factors like your daily commute distance, frequency of use, and budget to select the most suitable policy that meets your requirements.