Kicking off with does homeowners insurance cover tenants, this exploration delves into the coverage options provided by homeowners insurance for tenants, along with alternative insurance options available.

We will navigate through the complexities of insurance coverage for tenants living in rented properties, shedding light on important aspects and considerations.

Understanding Homeowners Insurance

Homeowners insurance is a type of property insurance that provides financial protection against damage or loss to a home and its contents. It typically covers damage caused by fire, theft, vandalism, and certain natural disasters. Additionally, homeowners insurance may offer liability coverage in the event someone is injured on the property.

Coverage Provided by Homeowners Insurance

Homeowners insurance typically covers the structure of the home, personal belongings, liability protection, and additional living expenses in case the home becomes uninhabitable due to a covered event.

- Structure of the home: Coverage for damage to the physical structure of the property.

- Personal belongings: Protection for personal items like furniture, clothing, and electronics.

- Liability protection: Coverage in case someone is injured on the property and the homeowner is found liable.

- Additional living expenses: Reimbursement for temporary housing and living expenses if the home is unlivable.

Scenarios where Homeowners Insurance is Beneficial, Does homeowners insurance cover tenants

1. Natural disasters such as hurricanes, tornadoes, or wildfires.

2. Theft or vandalism of personal belongings.

3. Accidental damage to the property.

4. Liability claims for injuries sustained on the property.

Importance of Homeowners Insurance for Property Owners

Homeowners insurance is crucial for property owners to protect their investment and provide financial security in case of unforeseen events. It offers peace of mind knowing that the property and its contents are protected against various risks.

Does Homeowners Insurance Cover Tenants?

Homeowners insurance typically does not extend coverage to tenants living in a rented property. The coverage provided by homeowners insurance is designed to protect the property owner’s interests and does not include coverage for tenants’ personal belongings or liability.

Limitations of Homeowners Insurance for Tenants

While homeowners insurance may cover the physical structure of the property and liability protection for the property owner, it does not extend coverage to tenants’ personal belongings or liability. Tenants are encouraged to obtain renters insurance to protect their possessions and liability.

Alternative Insurance Options for Tenants

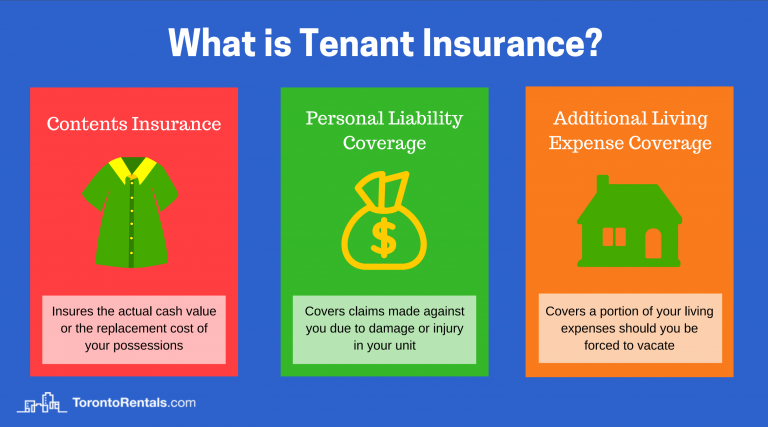

Renters insurance is a type of insurance designed specifically for tenants living in rented properties. It provides coverage for personal belongings, liability protection, and additional living expenses in case of a covered event. Tenants should consider renters insurance to ensure their assets are protected.

Liability Coverage for Tenants: Does Homeowners Insurance Cover Tenants

Homeowners insurance may provide liability coverage for tenants living in a rented property. This coverage protects tenants in case they are found liable for injuries or damages to others while on the rented premises. However, the extent of coverage may vary, and tenants are advised to consider additional liability insurance for added protection.

Differences in Liability Coverage Between Property Owners and Tenants

Property owners typically have liability coverage included in their homeowners insurance policy to protect themselves from claims related to injuries on the property. Tenants may have limited coverage under the landlord’s policy, highlighting the need for renters insurance for comprehensive liability protection.

Situations Where Liability Coverage for Tenants May Come Into Play

1. Accidental injury to a guest visiting the rented property.

2. Damage caused by the tenant to the landlord’s property.

3. Legal expenses in case of a liability lawsuit.

Additional Coverage for Tenants

Tenants can explore additional coverage options beyond homeowners insurance to protect their interests. Renters insurance offers comprehensive coverage for personal belongings, liability protection, and additional living expenses. By obtaining renters insurance, tenants can safeguard their assets and finances in case of unexpected events.

Final Review

In conclusion, understanding the nuances of homeowners insurance coverage for tenants is essential for both property owners and tenants. By exploring the limitations, alternatives, and additional coverage options, individuals can make informed decisions to protect their interests and assets.

FAQ Corner

Does homeowners insurance cover damage caused by tenants?

Homeowners insurance typically does not cover damage caused by tenants. Landlords may need landlord insurance to protect against such scenarios.

Can tenants purchase homeowners insurance?

Tenants cannot purchase homeowners insurance as it is designed for property owners. They can opt for renters insurance to protect their belongings and liability.

Does homeowners insurance cover personal belongings of tenants?

Homeowners insurance does not cover personal belongings of tenants. Renters insurance is specifically designed to cover tenants’ personal property.