Car insurance lawsuit takes center stage in the legal world, delving into the intricacies of legal battles surrounding insurance claims. From defining a car insurance lawsuit to exploring its various types and factors, this topic offers a comprehensive look at the complexities of insurance litigation.

Understanding Car Insurance Lawsuit

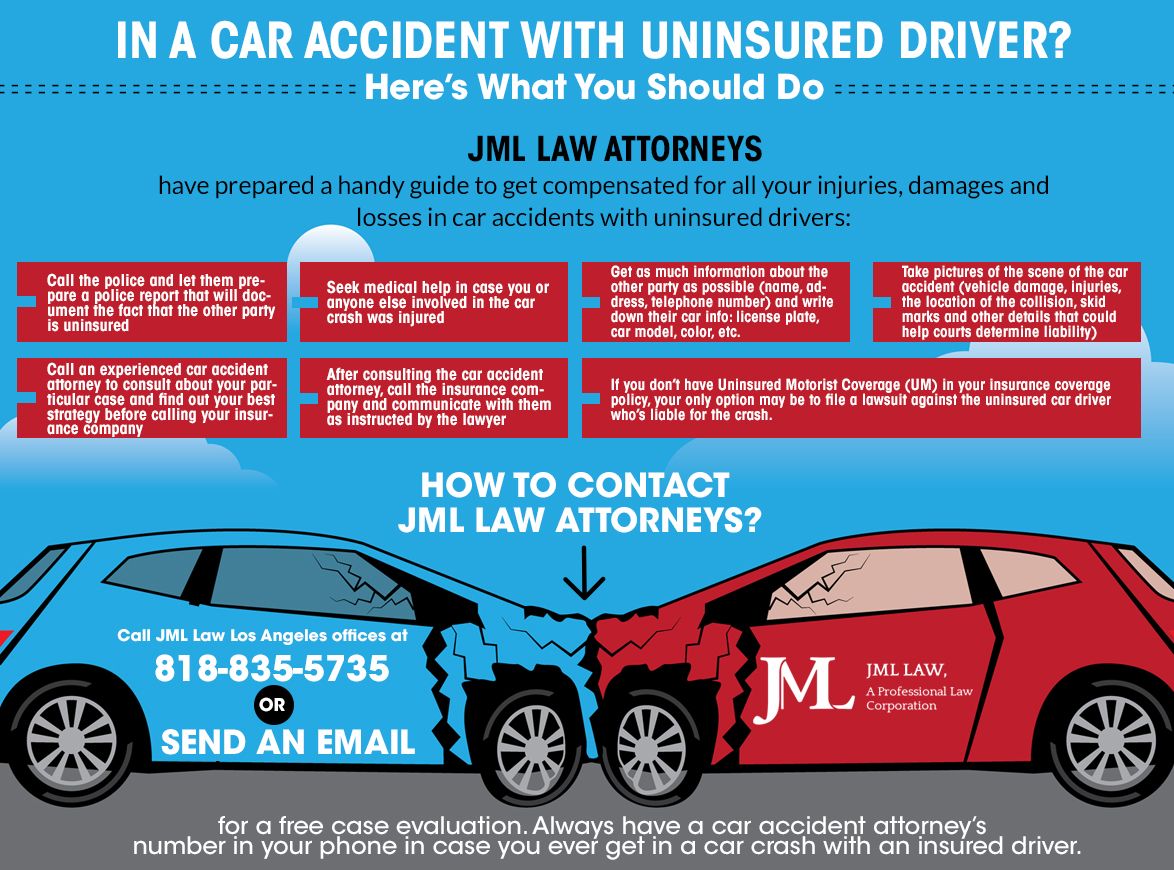

A car insurance lawsuit is a legal dispute between a policyholder and their insurance company or another party related to an incident covered by the insurance policy. Common reasons why car insurance lawsuits are filed include disputes over fault determination, coverage denial, or inadequate compensation. The legal process involved in a car insurance lawsuit typically includes investigation, negotiation, and potentially litigation if a settlement cannot be reached.

Types of Car Insurance Lawsuits

- Personal Injury Claims: These lawsuits involve seeking compensation for bodily injuries sustained in a car accident.

- Property Damage Disputes: These lawsuits focus on damages to vehicles or other property caused by a car accident.

- Coverage Denial Cases: These lawsuits arise when an insurance company refuses to provide coverage for a claim.

Factors Influencing Car Insurance Lawsuits

- Fault Determination: The allocation of fault in a car accident can heavily influence the outcome of a car insurance lawsuit.

- Coverage Disputes: Differences in interpreting policy coverage can lead to legal disputes between policyholders and insurance companies.

- External Factors: Weather conditions, road infrastructure, and other external factors can impact the circumstances leading to a car insurance lawsuit.

Legal Considerations in Car Insurance Lawsuits

| Legal Principles | Case Laws | State Regulations |

|---|---|---|

| Key legal principles include contract law, tort law, and insurance regulations governing car insurance lawsuits. | Examples of case laws like Smith v. Smith that have set precedents for car insurance lawsuit outcomes. | State-specific regulations can influence the resolution of car insurance lawsuits, such as mandatory coverage requirements or liability limits. |

Last Recap: Car Insurance Lawsuit

In conclusion, the world of car insurance lawsuits is multifaceted and influenced by various legal, financial, and external factors. Understanding the nuances of this legal process is crucial for both insurance companies and policyholders to navigate the complexities of insurance claims effectively.

User Queries

What are the common reasons why car insurance lawsuits are filed?

Car insurance lawsuits are often filed due to disputes over fault determination, coverage issues, or denial of claims by insurance companies.

How do external factors like weather conditions impact car insurance lawsuits?

External factors like adverse weather conditions can influence the occurrence of accidents, leading to an increase in car insurance lawsuits related to property damage or personal injury claims.

What role do insurance companies play in resolving car insurance lawsuits?

Insurance companies play a significant role in either settling car insurance lawsuits through negotiations or escalating the dispute to court for resolution.