AARP Secondary Insurance to Medicare offers a comprehensive overview of how this supplemental insurance works with Medicare, covering benefits, eligibility criteria, and coverage details. Dive into the intricacies of this essential topic to understand how it can enhance your healthcare coverage.

Overview of AARP Secondary Insurance to Medicare

AARP secondary insurance is a supplemental insurance plan that works alongside Medicare to help cover costs that Medicare does not pay for. This additional coverage can provide peace of mind and financial protection for individuals who may face gaps in their healthcare expenses.

Benefits of AARP Secondary Insurance, Aarp secondary insurance to medicare

- Enhanced coverage for services not covered by Medicare

- Lower out-of-pocket costs for prescription drugs

- Access to additional benefits such as vision and dental care

Eligibility and Enrollment

AARP secondary insurance is available to individuals who are enrolled in Medicare Parts A and B. To enroll in AARP secondary insurance, individuals must meet the eligibility criteria set by AARP and complete the enrollment process to supplement their existing Medicare coverage.

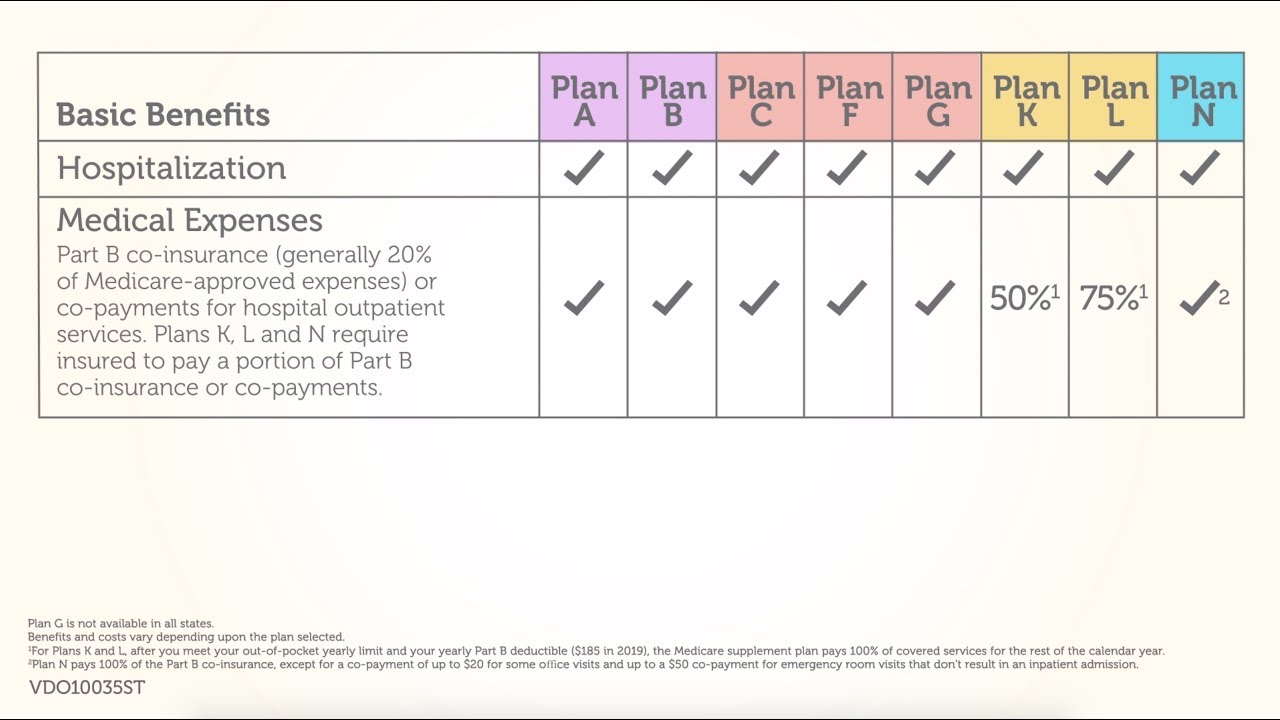

Cost and Coverage Details

| Costs | Coverage Options | Out-of-Pocket Expenses |

|---|---|---|

| Monthly premiums vary based on the plan | Various coverage options to choose from | Co-payments, deductibles, and coinsurance |

Customer Experience and Reviews

- Positive feedback on the ease of using AARP secondary insurance

- Satisfaction with the additional benefits provided by AARP

- High ratings for customer service and claims processing

Closing Summary

In conclusion, AARP Secondary Insurance to Medicare serves as a valuable addition to your healthcare plan, bridging gaps in coverage and providing peace of mind. Explore the possibilities of this insurance option to make informed decisions about your healthcare needs.

FAQ Explained

Who is eligible for AARP secondary insurance to Medicare?

Individuals aged 65 and older who are already enrolled in Medicare Part A and Part B are typically eligible for AARP secondary insurance.

What costs are associated with AARP secondary insurance?

The costs of AARP secondary insurance can vary based on the plan chosen, but they generally include monthly premiums, deductibles, and co-payments for covered services.

How does AARP secondary insurance complement Medicare coverage?

AARP secondary insurance helps fill in the gaps left by Medicare by covering additional services, such as vision, dental, and hearing aids, that are not typically covered by Medicare.